We have collected data and statistics on Zoom. It acquired Solvvy in May 2022, which sells conversational AI and automation packages to customer support centres. To fix that, Zoom is aiming to expand the amount of services it can offer to businesses. decreasing the need for business travel, others may view a subscription to our. Zoom still remains a very popular service, but as most of the world has returned to some form of office work, it has lost a bit of its shine. We have two classes of authorized common stock, Class A common stock and.

This compares to 10 million in December 2019. The stock plunge started Monday evening after the companys second-quarter earnings release, in which Zoom posted record revenue of 1 billion (up 54 year over year) despite executives. The following month, this figure had risen to 300 million. Flurry of new rules leave Turkish banks struggling to lend -sources. Yuan stated in a blog post that over the course of May 2020, Zoom was seeing 200 million daily meeting participants. The Nasdaq Composite has surged 31%.The Keyword Optimization Cycle simplifies finding the best keywords by providing a template to effectively structure your research process. Over that same span, the S&P 500 has tacked on 20%. The steep sell-off pushed shares of Zoom into the red for the past year, down about 2.5%, according to Yahoo Finance Plus data. Zoom shares crashed more than 16% to $293 on Tuesday's session. "I think we were talking about most of us are probably socializing in person now, doing fewer things like Zoom Happy Hours, and that's where we are starting to see some of the challenges," acknowledged Zoom CFO Kelly Steckelberg on an earnings call with analysts. Zoom saw slowing sequential growth rates in customers spending in excess of $100,000 a year with the company (131% in the second quarter versus 160% in the first quarter) and spending with 10 or more employees (36% growth in the second quarter versus 67% growth in the first quarter). Radke called the earnings report disappointing.

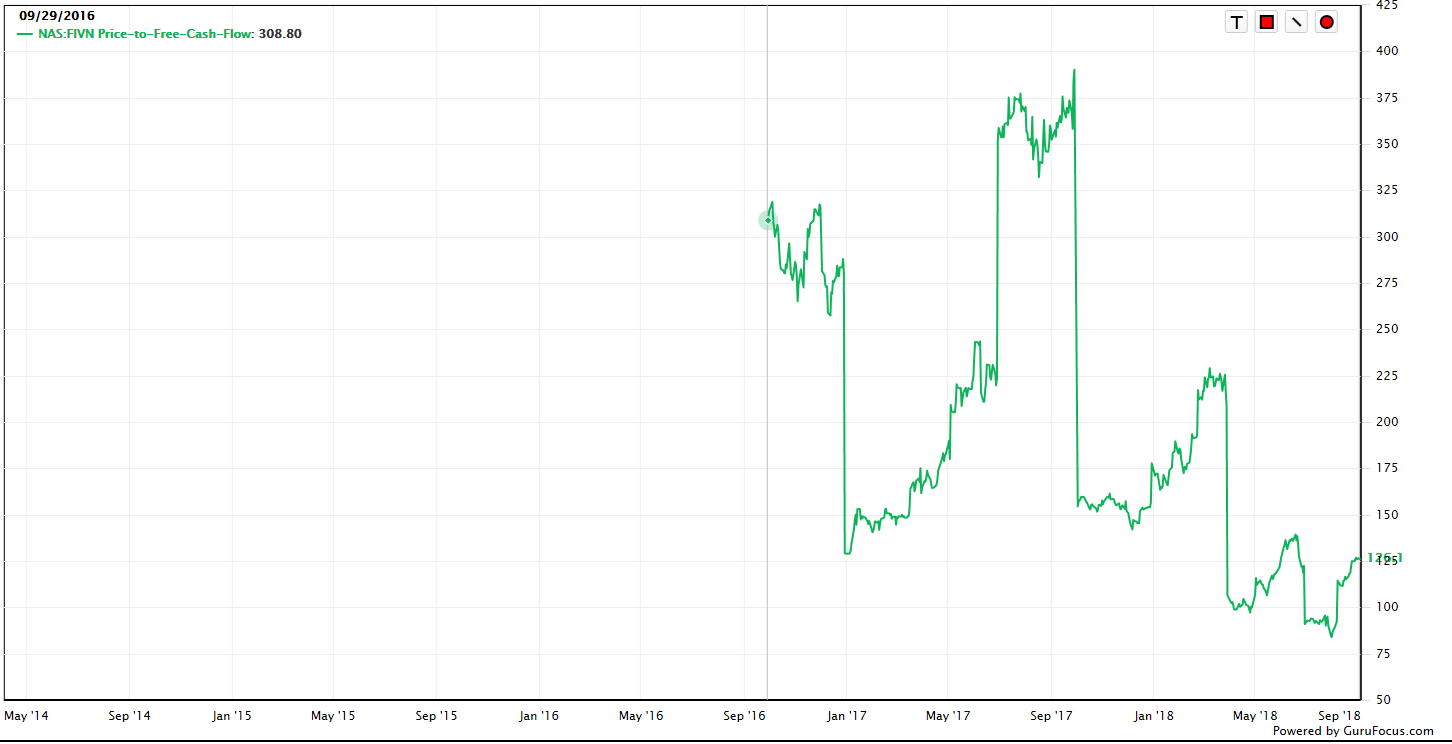

"We are wary of a potential demotion for Zoom from hyper-growth to growth at a reasonable price,” said Citi analyst Tyler Radke, following Zoom's underwhelming second quarter results Monday evening. So the only course of action right now it seems - sell Zoom's stock ( ZM) and wait for more stable waters. The Street is unclear on how to value Zoom as its growth slows with people returning to offices and schools, despite the lingering pandemic.

0 kommentar(er)

0 kommentar(er)